property tax in france 2020

Residence tax or occupiers tax - Taxe dHabitation. So this year 2020 you will be declaring according to your situation between 1 January 31 December 2019.

French Taxes I Buy A Property In France What Taxes Should I Pay

This French housing tax deemed unfair.

. Contact us on 44 020 7898 0549 from. The overall rate of. The main change is a reduction in the income tax rates for calendar year 2020.

Thats why we have created this tool in order to help you estimate your personal income tax burdern in France based on the latest fiscal data from the French authorities for 2019. The tax typically amounts to between. The tax is charged.

Unmarried couples should complete separate tax returns. Taxes account for 45 of GDP against 37 on average in OECD countries. The tiers of wealth.

Tuesday 10 November 2020. For example If you are buying a primary home in France the property tax rate is around 1. A summary of French tax rates 2020.

In French its known as droit de mutation. For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate. CFE is an annual tax which is paid by owners of furnished properties in France based on the theoretical rental value of their property.

But if you are buying secondary homes you will be charged 3. Over the past two years. Reduced tax rate for lower income in France for 2020.

June 12th closing date for tax declarations done on paper. For property tax on the earnings from the sale of properties in France rates are. If you need assistance with your move we have a team of France property experts that can help at every crucial stage.

In 2018 France abolished wealth tax on financial assets replacing it with IFI Impôt sur la Fortune Immobilière which is only applicable to real estate assets. The rate of stamp duty varies slightly between the departments of France and depending on the age of the property. More households will be exempt from the taxe dhabitation this year as the gradual abolition of the tax continues.

This is why France continues to be among the OECD countries whose tax rate is the highest. Speak to an expert. There are two local property taxes in France payable by both residents and non-residents.

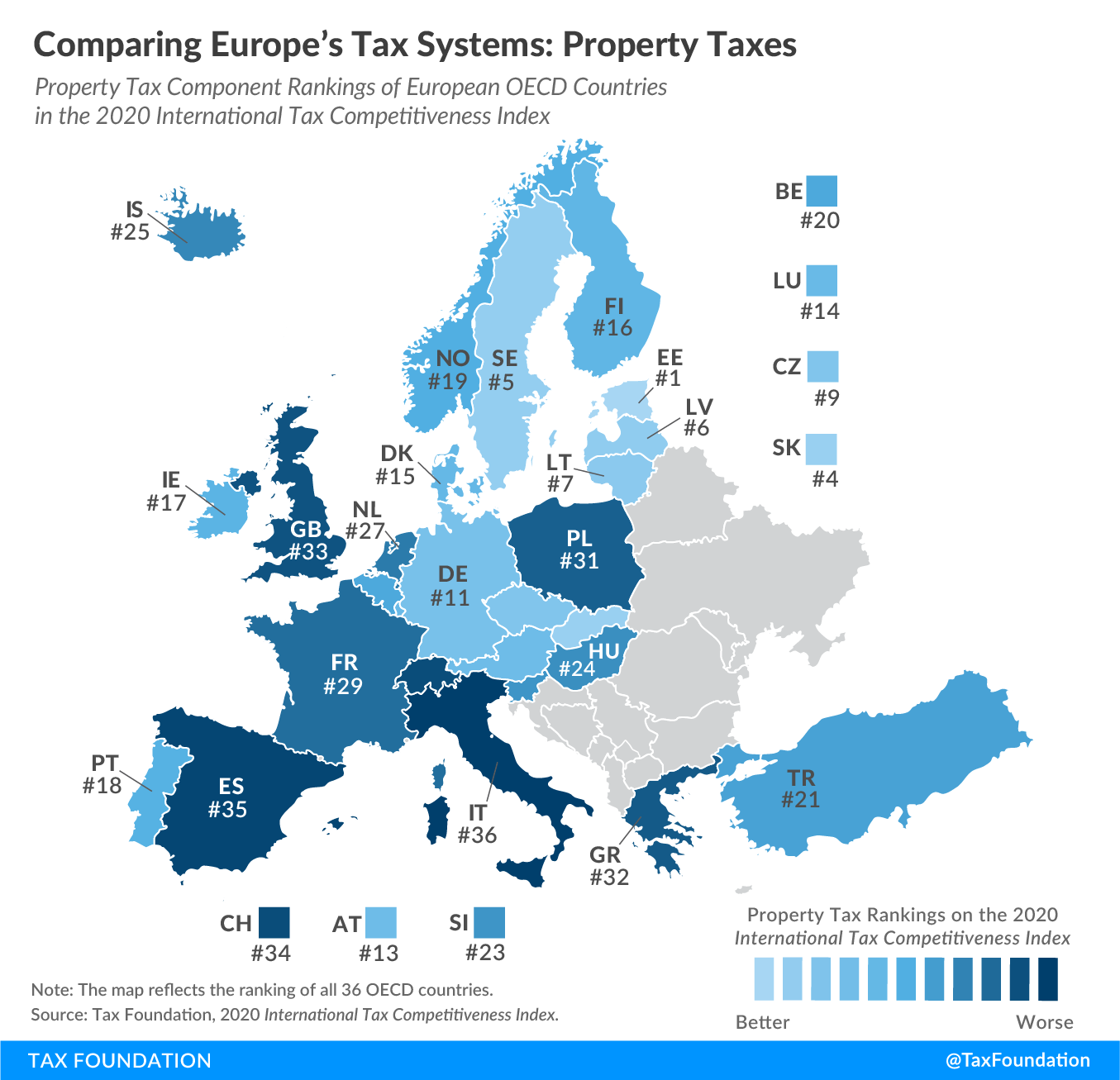

This relates to taxes owed for 2019 and anyone resident in France from April 2019 and onwards needs to fill in a return. 29 rows The highest property taxes as a share of the private capital stock occur in the United Kingdom 193 percent France 125 percent and Greece 109 percent.

New Zealand Tax Income Taxes In New Zealand Tax Foundation

Taxe D Habitation French Residence Tax

Real Estate Newsletter Template Fall 2020 Newsletter Real Etsy In 2022 Newsletter Templates Real Estate Real Estate Marketing

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation

Pib Per Capita 2018 Instagram Posts Europe Map

French Taxes I Buy A Property In France What Taxes Should I Pay

French Property Tax Considerations Blevins Franks

350 Best Real Estate Company Names Of All Time Real Estate Company Names Best Company Names Great Company Names

French Property Analysis Of The Market Notaires De France

Taxe D Habitation French Residence Tax

Property Taxes Property Tax Analysis Tax Foundation

Will County Announces Property Tax Relief Measures For 2020 Estate Tax Property Tax County

3great Magazines 1 France January 2021 Issue 268 2 Country Smallholding December 2020 3 French Property News December 2020 Issue 358

Benefits Of Mixed Use Development Infographicbee Com Mixed Use Development Development Data Visualization

Taxes In France A Complete Guide For Expats Expatica

Property Taxes Property Tax Analysis Tax Foundation

Property Taxes Property Tax Analysis Tax Foundation

In Depth Guide To French Property Taxes For Non Residents Expats

Christmas Cheer For Larger Stores Boost Real Estate Prospects In Central Athens